Exclusive interview with Dr Yahia Abdul Rahman CEO of LARIBA Bank of Whittier, NA The First Riba Free Bank in American History

Islamic banking in the US: Dr. Yahia Abdul Rahman Chairman and CEO of the LARIBA Banking Group – LBG which operates LARIBA American Finance House and the Bank of Whittier, National Association discusses the history and future of Islamic banking in America and the World

Islamic banking in the US: Dr. Yahia Abdul Rahman Chairman and CEO of the LARIBA Banking Group – LBG which operates LARIBA American Finance House and the Bank of Whittier, National Association discusses the history and future of Islamic banking in America and the World

www.LARIBA.com and www.BankOfWhittier.com

Thirty five (35) years ago, the LARIBA Banking Group – LBG (Bank of Whittier, NA) pioneered RF (Riba Free) banking Services in America in 1987

The Bank is the ONLY COMMUNITY-OWNED and FULL-SERVICE RF (Riba Free) National Bank in AMERICA with FULL ONLINE BANKING and Smartphone APP services.

The Bank serves in ALL 50 States. The Bank offers the same on-line FinTech services available at Citi, Chase, and Bank of America. Its ATM Visa Debit cards are recognized at all US-based Citibank and Bank of America ATM machines. The ATM Card is recognized at over a million ATM machines worldwide. The Bank also offers Zelle online Money Transfer Service.

- Why did you want to establish a bank based on the “RIBA Free” Concept? Could you please introduce the concept more to us?

Before I travelled to America to continue my education in 1968, I read a small book titled “Bonook Bela Fawa’ed فوائد بنوك بلا(Banks without Interest) by Prof. Eissa Abdou. It captured my imagination and I decided to learn more about it.

When I arrived in America in 1968 there were no mosques or Islamic Centers. We started Jumaa Prayers at the University student Union and prayed in the basement of buildings. When my wife joined me, we started a weekend school for the children of the graduate and other students.

After completing my Ph.D. in November1971, we moved to Dallas, Texas. I started working for a large oil company. There were no Jumaa prayers there. So, we – a friend and I – started the very first – two persons -Jumaa in November 1971 at a public park. This prompted us to start activating the Islamic Association of North Texas (IANT). The community grew in number and today there are at least 28 Islamic Centers in the area.

We decided to buy our first Islamic Center in 1973. We did not have enough money. So, some community members suggested that we borrow money from a bank. That started a big discussion about Riba! And that triggered in my mind what I have read in Prof. Eissa Abdou’s book. We purchased the property without using riba loans. We used instead Qard Hassan (interest free benevolent loans).

During my years in America, since February 1968, I was invited to motivate communities to start and help organize their centers and Islamic schools for their children. We collected donations to buy these facilities without Riba. It was hard and it consumed my family’s weekend’s time. Upon coming back from these trips, I would pray that Allah will help me establish a financial institution that would gather the savings of the community and would professionally and prudently reinvest these savings back in the community riba-free.

This triggered the dream of starting a Riba-Free financial institution in 1987. We called it LARIBA (No Riba) لاربا.

It was my honor to become a member of the startup team of the Industrial Bank of Kuwait in 1974 – 1975. In fact, I returned 1984-1986 to help in restructuring the Industrial Bank after the Souk Almanakh stock market crash سوق المناخ. While in Kuwait, I was introduced to the activities of the Kuwait Finance House. So, we called it American Finance House. We also used the brand name: LARIBA (which means no Riba).

LARIBA is now well known worldwide. We raised a small capital from friends. Some invested $5,000 others invested more. We raised $200,000. We started our first Riba-Free (RF) transaction by financing the first ever Rib-Free (RF) mortgage in America in1987.

- What were the challenges that faced the LARBA and Bank of Whittier at the begining? And what are the current challenges?

We start with the Start Up Challenges:

- We did not have Enough Capital.

Starting a bank required at least $10 million in capital. We were advised to start a finance company. It did not require too much capital. So, we started LARIBA with the $200,000.

- Finding an Easy to Understand and Popularize Definition of what Riba is?

We developed one: Riba is defined as: The Act of Renting Money at a price called interest rate. Money cannot be rented. It can ONLY be invested because it changes its nature upon use like an orange or a loaf of bread. So, it can only be used when it changes title of ownership from who own it to the other party to invest it. That is why all Riba-Free transactions must be in the form of investments with the inherent potential for a profit or loss.

- We were Not Educated about Islamic Banking:

We started studying the history and rules of the prohibition of renting money using interest in the Old Testament -Judaism, the New Testament-Christianity (Catholic and Evangelical) and in the Qur’aan and Sunnah-Islam.

By mere coincidence, in 1987, I met a prominent leader – رحمه الله– (Rahmiahu Allah – may Allah bless his soul) in the new and emerging Islamic Banking movement then. He and I became close friends. We agreed that he’ll help me learn about Islamic banking. So, he invited me to meetings with top scholars and experts in the field. He and I decided to keep LARIBA a company owned by the American Muslim community.

- The American Banking and Finance State and Federal Authorities did not know about us as professionals, our background and expertise. They also did not know what Islamic Banking is and how it works.

We did not know which Islamic finance model to use. We started with Murabaha (Cost Plus) but we were vehemently criticized by the well-educated and devout member of the community. They felt that it is similar to any riba-based bank transaction.

That prompted me to intensify my study of the Real Spirit and Roots of the prohibition of riba. This resulted in publishing a textbook published by one of the largest publishing houses in the world – John Wiley & Sons (20,000 copies sold worldwide on Amazon. It was rated by Amazon among top 10% best seller in 2010 and issued second edition in 2014 as a textbook)

The book and a research paper by the Malaysian Research Academy ISRA documented the unique model we are using now: The LARIBA RF Finance Model based on Bai Ul Istithnaa بيع الاستثناء – “بيع “ملك الرقبة” باستثناء “حق المنفعة”

Here is a Listing of the Current and Future Challenges:

- Lack of Qualified and Trained RF (Riba Free) Bankers and Staff.

We are working hard to train as many fresh graduates as possible.

- The Fierce Competition from the well-established Mega Riba-Based Banks.

We still can compete with them at our institution, but it impacts our profit margins. We make up for the competition by reducing loan losses because of our strict underwriting standard and our LARIBA RF Finance Model

- Lack of Clear Understanding of the Added Value of RF (Riba Free) Banking.

Many customers are confused about RF services. Because of that we find many of the RF Banks’ customers are migrating away to riba-based banks. It is felt that this happens mainly because they erroneously feel that Islamic Riba Free banks are:

3.1. More expensive,

3.2. That there is no difference or added value.

3.3. That Islamic Bankers are using religion to sell and enrich themselves.

3.4. All they do is change words and names to make it sound Islamic but it is actually the same.

Our unique model shows beyond doubt a proven added value in addition to the distinguished services offered to our clients.

- Lack of Educated, Well-planned and Well-financed Mass Popularization of Going Riba Free and Living a Riba Free Lifestyle

By using “sitcom” TV series, movies, news magazines’ articles,…etc.

- Whittier Bank is mainly located in the United States. Is there an open future in the Gulf countries or other Islamic countries?

We shall be happy to contribute by sharing our humble experiences when needed but of course we are capital poor compared to your country.

- What makes this Model of LARIBA – The “Sale of Title with the Exception of Usufruct” is different from other commercial mortgage models (except naming the monthly payments as lease payments rather than interest payments)?

The Main problems in the Islamic Banking Movement are:

- Calling it Islamic. This has limited its use to ONLY the devout Muslims.

We want to open it up to all people of all faiths and orientation as a window of inviting the world to experience the benefits of:

- Living a Riba Free Lifestyle,

- Applying the RF (Riba Free) Discipline in their financial dealings, and

- The quality of service they get when they deal with the RF (Riba Free) bankers.

That is why we call it RF – Riba Free – which is what it is.

- Until Now we have not included the Most Important Aspect and Feature of RF Financing. It is the RF Monetary Definition of the Value of Currencies.

The Prophet (s) has a very well-known hadeeth on the RF (Riba Free) monetary discipline in which he defined the Calibration References for valuation. These are:

- Precious Metals: Gold & Silver, and

- Food Staples: at the time it was Wheat, barley, Dates and salt but it changes depending on location. For example it is Rice in Asia, Corn in Latin America,..and so on.

Because Gold or Silver (as well as Food Staples) is a calibration unit they:

- Cannot be involved in any futures or speculative markets.

- Cannot be involved in short sale activities or options trading.

They are treated in the RF Monetary Discipline like a Kilogram, the standard for weight or a Meter, the standard for length, as a standard and constant scale of measurement. The Calibrating References for Value have to be fixed as references.

We use this fundamental Discipline as a Macro Tool to Test for Price Bubbles in the Economy.

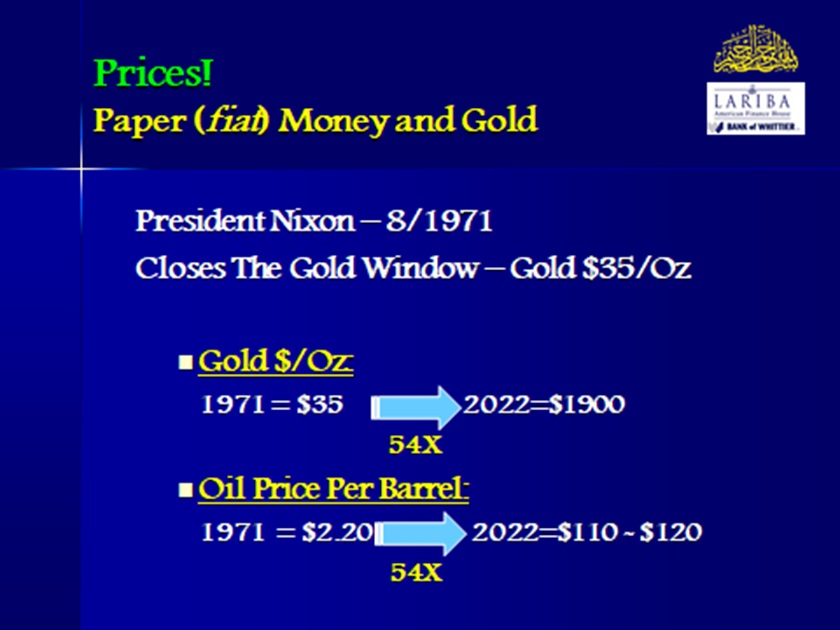

Take the Case of Oil Prices: In US $ they keep going up. But if we refer prices of oil to gold the story is different.

Another example is a loan of $100,000 in March 1971 and the agreement was not to charge interest. The agreement was to pay it back in June 2022 in the equivalent of gold. In 1971, at $35 per ounce of gold, a $100,000 would buy you approx. 2,820 ounces of gold. So, in 2022, I get paid the equivalent of 2,820 ounces of gold in any currency. In terms of US dollars, which will be equal to 2,820 ounces multiplied by $1900 an ounce of gold which equals to $5,358,000.

This shows the value of RF Monetary Discipline which has been overlooked in the Islamic Banking movement worldwide.

That is why we at LARIBA Banking Group LBG we keep track of prices in US$ and in Reference Calibration Commodities (Gold, Silver, Wheat, and Rice) on a quarterly basis to detect any price bubbles to avoid or to uncover an attractive pricing that offers a good buying opportunity. Let me show you the case of using gold as a reference:

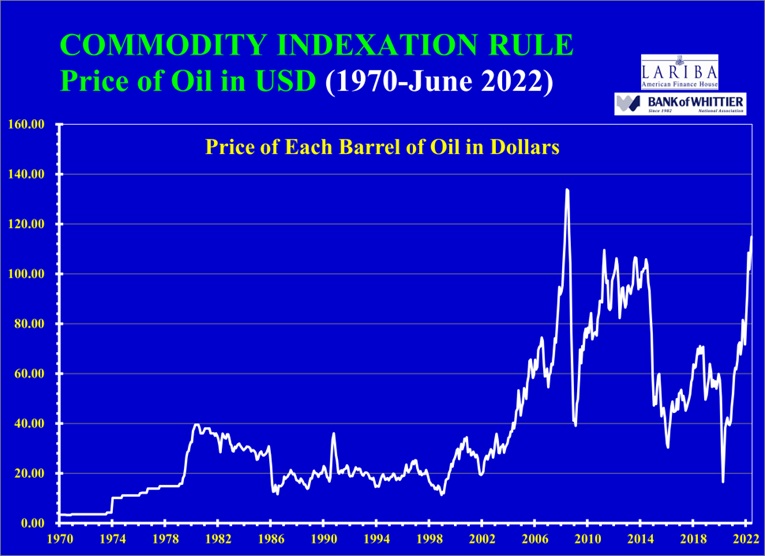

OIL PRICE

The following chart shows the history of crude oil price in US dollars.

As you can see it keeps going up except in times where there is political instability:

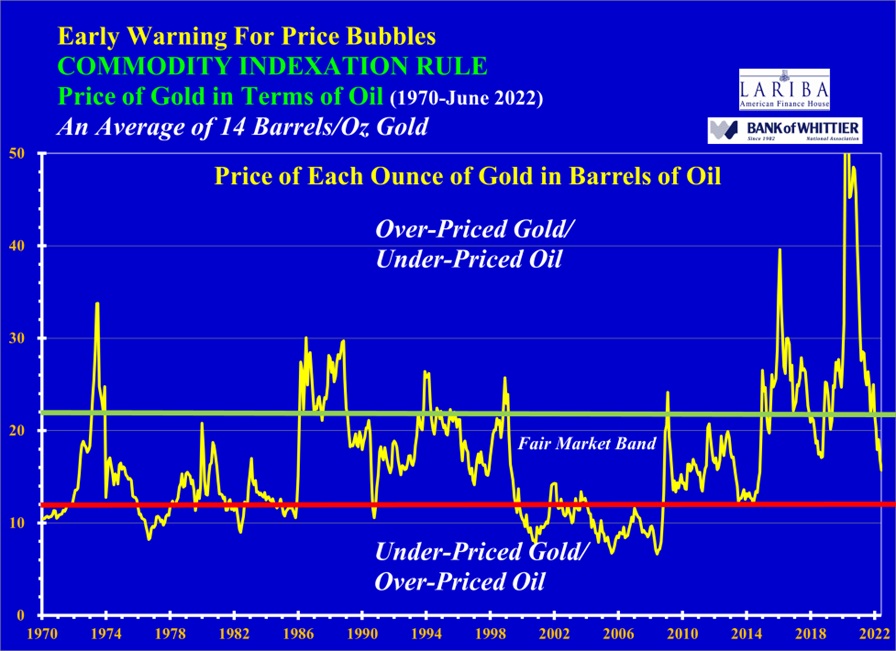

If we convert oil prices to find how many Barrels of oil we can get for a price of one Ounce of Gold, we shall see a cyclical behavior and we can discover out if oil is sold cheap or expensively.

Look at the chart below. It shows that on average an ounce of gold can buy 12 to 14 barrels of oil. Look at the manipulation in oil price in its real RF valuation method.

Please note that the channel with a GREEN TOP LINE and A Red BOTTOM LINE shows the fluctuation channel of market forces of supply and demand. If the chart penetrates the RED LINE lower, then Oil is OVER-PRICED and Gold i=s underpriced. If the chart penetrates the GREEN LINE higher than the Oil is cheap, and Gold is expensive. The Chart shows that oil is now fairly priced.

NATURAL GAS

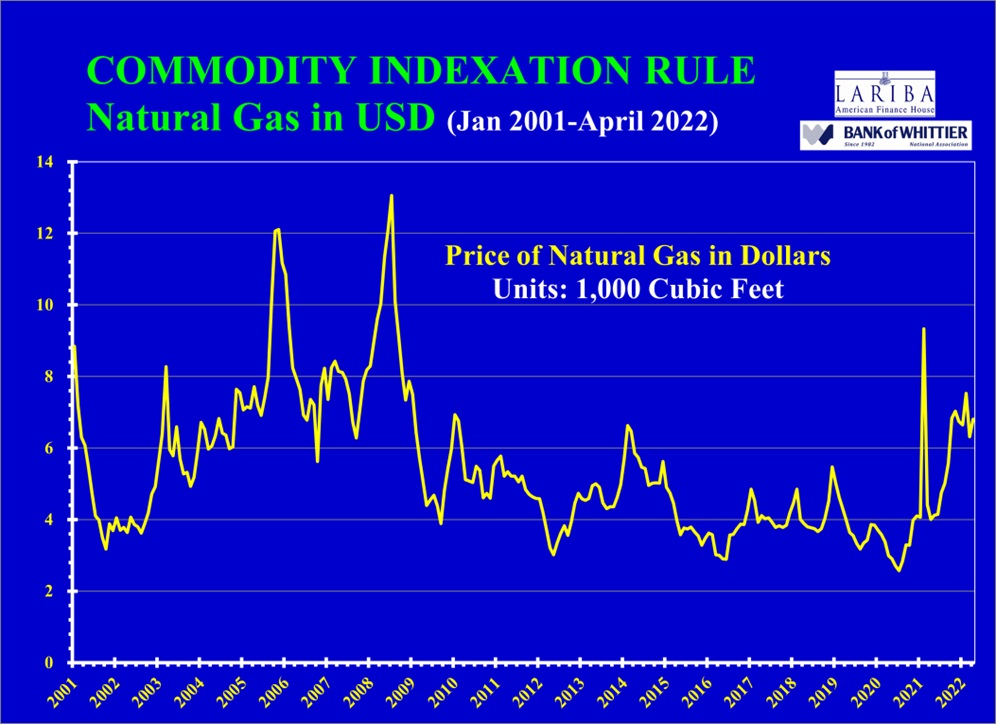

The same analysis can be applied to Natural Gas price. Notice the price of natural gas in US$ before and after the Ukraine crisis:

Now, look at the chat below for Natural Gas price in Gold. It shows that natural gas was extremely cheap before the Ukraine war but returned to its normal prices after the war. It shows how powerful it is to use the RF Monetary Discipline to discover real value of things in the market. The chart shows that nowadays the gas is fairly priced.

BITCOIN PRICE:

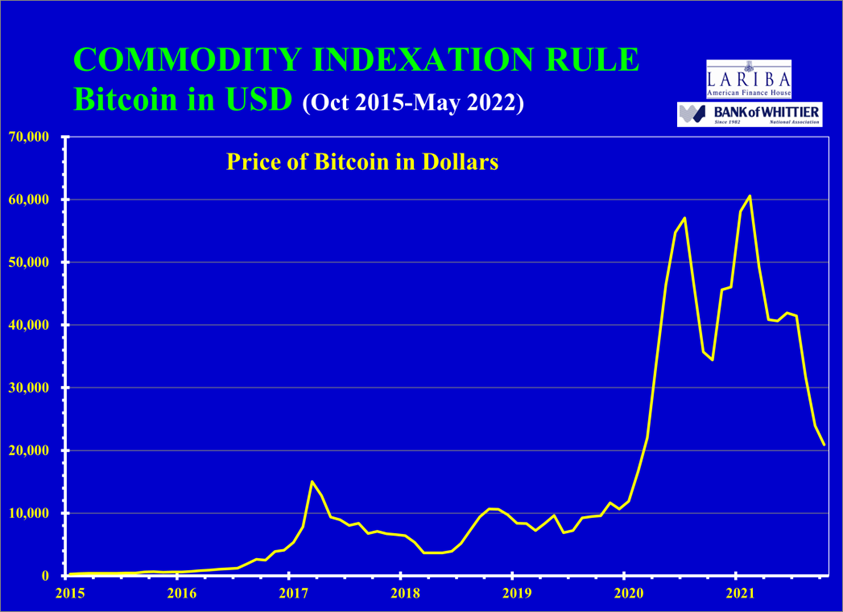

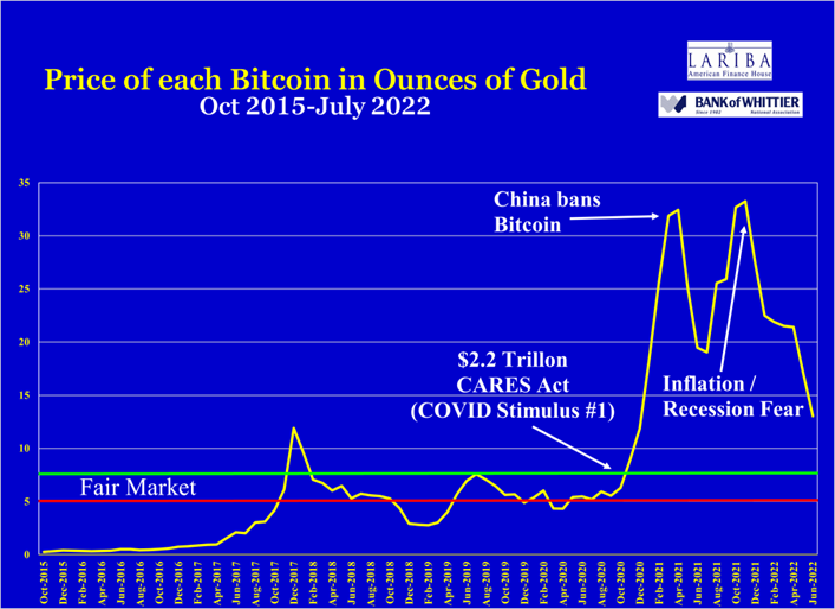

The same applies to Bitcoin Prices. In fact we insisted that when Bitcoins reached $75,000 we insisted that a fair price of a Bitcoin is between $15,000 and $25,000. The reason, again, is the valuation using the RF monetary Discipline of valuation:

Here is the history of the value of a Bitcoin in US Dollars:

And below is the valuation using the F Monetary Discipline of discovering the real value of the Bitcoin. Based on the chart below the fair price of a Bitcoin should be approx. 5 to 7.5 ounces of gold. At approx. $1,900 an ounce of gold, the RF Monetary Valuation of a Bitcoin is $10,000 to $15,000.

- The practice, in many cases, of trying to take the Riba-Based banking products and “Islamize” them has resulted in diluting the SPIRIT and the Intent of RF (Riba Free) Discipline.

The following detailed description of our model shows the real added value of RF (Riba Free) Financing which is to make certain that investing in this home, car, business or commercial building makes PRUDENT Economic sense, that it is not overvalued and that there is no economic price bubbles (An Arabic Translation is attached) :

The LARIBA RF MODEL – Structure & Procedures

LARIBA Residential Property Financing Model “Declining Participation in the Usufruct (DPU)” is a financing model based on the financial institution purchase of the property jointly with the client. Then, at the request of the clients out of their free will, the RF finance entity buys the RF finance entity’s share except for the usufruct at the same price with no increase. This model of sale was pioneered by the Prophet (S) when he sold his camel’s title of ownership at the point of sale with the exception of using it to transport him from the point of sale to his home. It is called: Bai’u Al-Ain m’a Istithna’e Al-Manfa’a:

“بيع الإستثناء” بيع العين” مع استثناء “حق المنفعة” و يسمى اختصارا”

LARIBA does not start with an interest rate (interest is the rate of rental of money which is Riba) but relies on the market researched and documented actual rental value of a similar property in the same neighborhood provided by the customer and the finance officer independently.

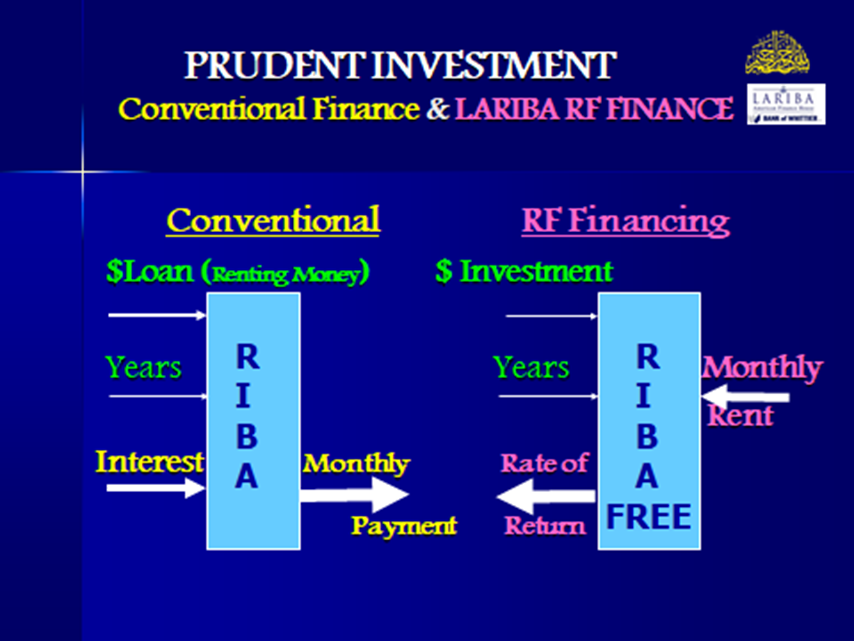

In the traditional Riba-Based transactions the bank uses an amortization program. They input: The amount of money to be rented, the number of years and the rental rate of money; i.e. interest rate. The Unknown Output is: The Monthly payment.

In the LARIB RF Proprietary program, we do the OPPOSITE! We input the amount of money to be INVESTED (not rented), the number of years and the income expected based on the average rental rate of a similar property in the same neighborhood in $/Sq. Ft. The unknown is the Rate of Return on investment. Here we test for the PRUDENCE of investing in this property. We have a number of scenarios. If the Rate of Return is:

- Higher or Equal to the Rate in the market as charged by the competition, LARIBA approves and tests if the monthly payment is competitive with the other banks. If it is higher, LARIBA voluntarily reduces the rental ate to compete with the Riba-based banks to provide customers with a fair-priced RF Deal.

- Very low indicating that it is imprudent to invest in this property, LARIBA declinesinvesting / financing and advises the customer that the property is overpriced even though the appraised value may indicate otherwise.

This is what saved many of LARIBA customers from participating in the US economic price bubble of 2008.

The Difference between the Riba-Based and the LARIBA RF Finance Model is shown in the chart below.

- How can the bank adapt nowadays to the increasing interest rates from The Federal Reserve which also affects the inflation rates?

Our model takes care of that because it uses the actual live market rent in the active market.

- Can Whittier bank adopt new economic models that also depend on the “RIBA Free” concept?

Yes, we can finance commercial buildings, cars, masjids (mosques) using this unique and Shari’aa compliant and based LARIBA RF Finance model.

- Is Whittier bank open to the idea of “Digital Banking”?

- We have been using digital (FinTech) banking since 1988 starting with our LARIBA.com in 1988. We now serve ALL 50 states in America Riba Free using Internet Banking and the Smartphone App (like 50 countries).

- Our Internet Banking websites LARIBA.comand www.BankOfWhittier.com have been very active. We started internet banking at LARIBA in 1988 and reached 1 million visitors in 1995.

- Our Bank of Whittier core processor is the same as Bank of America and other major banks in America (Fiserv Company).

- We offer a Smartphone APP which allows many services like remote deposits, remote banking, and “Zelle” money transfers.

- Our ATM Visa Debit Cards are recognized at over one million ATM Machines worldwide. The Cards are also accepted for cash withdrawal with no fees charged at all Citibank and Bank of America ATM Machines in the USA.

- Our FinTech Digital strategy is called: Wise-FinTech. While most banks design their digital banking to keep the customer away from the branch of the bank, we have designed it to get involved with deeply with the customer because our mission is to expose our customers on how a Riba Free Banker operates with honor, genuine love and respect, honors the promises, advises the client with what is good for them not what generates money for the bank and commission for the banker.

- Does the bank accept managing funds for precious metals for investment, buying and selling, and entering the world of decentralized management (block chain)?

Regarding fund management, investments in stocks and precious metals: these are handled by another category of financial institutions called Investment Banks. We are a Commercial Bank. As to the Block Chain concepts, these are applicable to large systems with large customer base. We are still small.

- Where do you see RIBA free banking, the LARIBA “RIBA Free” mortgage model, and Bank of Whittier in the next few years?

We expect very good growth inshaa Allah.

- The first source of growth is the new American-Born Muslims (our children and grandchildren). A significant portion of them insists on RF (Riba Free) banking. The real motors behind that have been the young wives and future mothers who influence their family and husband to go Riba Free and refuse to live with any haram income into their house.

- The second is the average Americans at large, regardless of their affiliation, including those Muslim Americans who are not yet committed to RF Banking. This category of the population is hearing about the reputation of RF Banking and the RF Banker. They refer their friends. They also are referred by the category described above.

We expect the assets of RF (Riba Free) Bank of Whittier to grow by the grace of Allah from what it is at now – $175 Million – to about $500 million by the year 2027 and inshaa Allah One Billion by 2032. Please join us I prayers to achieve these levels.